The Paris Agreement seeks to limit the negative impacts of global warming. Its goal is to keep the increase in global average temperature well below 2 degrees Celsius above pre-industrial levels, along with pursuing efforts to limit the increase to 1.5 degrees Celsius (2.7 degrees Fahrenheit). The signatories committed to eliminating global net carbon dioxide emissions in the second half of the 21st century. The Antarctic ice sheet is much less likely to become unstable and cause dramatic sea-level rise in upcoming centuries if the world follows policies that keep global warming below the set targets.

Implementation of the Paris Agreement requires economic and social transformation, based on the best available science.

“Putting sectors on net-zero pathways requires not only investing in new green technologies but also proactively phasing out carbon-intensive assets, and addressing the impacts of that transition on workers and communities.”

Businesses remain at risk due to the likely impacts of climate change. Aware of this, investors are measuring companies’ commitments and performance on GHG emissions and climate risk, specifically in carbon-intensive sectors, and demanding reporting on ESG factors. Carbon dioxide levels today are higher than at any point in at least the past 800,000 years. The onus is on companies to be able channel efforts to ensure that decarbonization is discussed from boardrooms to copy rooms.

Putting sectors on net-zero pathways requires not only investing in new green technologies but also proactively phasing out carbon-intensive assets, and addressing the impacts of that transition on workers and communities.

Carbon Management Technologies

Managing fossil fuel emissions will be a necessary part of the journey towards a net-zero future. Carbon management technologies like carbon capture, utilization and storage (CCUS) is a key step. CCUS is an important technological option for reducing CO2 emissions in the energy sector and will be essential in achieving the goal of net-zero emissions.

The power sector is the largest emitter of CO2 today, at around 40% of global energy-related CO2 emissions. There are three options for cutting locked-in emissions in the power generation and industrial sectors:

- Investing in modifications to existing industrial and power equipment to either use less carbon-intensive fuels or improve energy efficiency

- Retiring plants before the end of their normal operating lifetimes, or making less use of them (e.g., by repurposing fossil fuel power plants to operate at peak-load rather than base-load)

- Retrofitting CO2 capture facilities and storing or using the CO2

Scaling up CCUS technology will not only address this environmental scourge but can also deliver branding benefits for companies along with lower risks for business continuity as policies increasingly turn green. But such carbon technologies will require a lot of funds, and largely from private capital.

Private capital is crucial in unlocking carbon capture

The Global CCS Institute estimates the capture capacity of the 50 or so CCUS facilities globally at around 96 million tonnes of CO2 annually, a fraction of the 40 billion tonnes of CO2 emitted globally each year. The Energy Transitions Commission estimates as much as $5 trillion is needed by 2050 to create the capacity for carbon removal, which would include technologies like carbon capture and storage. But where would funding on this scale come from?

Private capital is often disincentivized from looking at nascent technologies (that target the SDGs) due to a lack of reporting and disclosure of data, because this impedes financiers’ ability to assess and monitor the project. This is where mandating of the TCFD disclosure framework could be a game-changer – starting with the UK and also for other geographies who follow the UK’s decision. The framework set out by the TCFD requires companies to provide specific data to evaluate climate risks, which is precisely what CCUS seeks to do. The mandating of TCFD disclosures can be the means to achieve that end.

Financial Instruments to support decarbonization

Reducing investment risks is important for fostering investment in the development of solutions for enhancing energy efficiency and reducing the carbon intensity of fuel/energy vector.

A number of financial measures relate to the fundamental idea of involving the public sector in the assumption of risks that would otherwise need to be borne by private investors. Key examples include:

- The availability of financing from public entities at low interest rates

- Loan guarantees, i.e., the public sector undertakes to pay some or all the debt in the event the investor fails to pay

- Credit insurance products for bond financing, i.e., insurances agreeing to pay a bond in the event that a payment default occurs by the issuer

- Use of environmentally friendly bonds is increasingly gaining relevance as a source of low-cost financing or refinancing for “green” and climate-friendly projects

- In Europe, a Technical Expert Group (TEG) on sustainable finance recently proposed a voluntary, non-legislative EU Green Bond Standard to enhance the effectiveness, transparency, comparability and credibility of the green bond market and to encourage the market participants to issue and invest in EU green bonds

Circularity is making inroads into the linear economy and has moved beyond the proof of concept

A circular economy is a systemic approach to economic development designed to benefit businesses, society, and the environment. In contrast to the ‘take-make-waste’ linear model, a circular economy is regenerative by design and aims to gradually decouple growth from the consumption of finite resources.

The concept recognises the importance of the economy needing to work effectively at all scales – for big and small businesses, for organisations and individuals, globally and locally.

It is based on three principles:

- Design out waste and pollution

- Keep products and materials in use

- Regenerate natural systems

“With current advances, digital technology has the power to support the transition to a circular economy by radically increasing virtualisation, de-materialisation, transparency, and feedback-driven intelligence.”

The potential benefits of shifting to a circular economy extend beyond the economy and into the natural environment. By designing out waste and pollution, keeping products and materials in use, and regenerating rather than degrading natural systems, the circular economy represents a powerful contribution in achieving global climate targets. With current advances, digital technology has the power to support the transition to a circular economy by radically increasing virtualisation, de-materialisation, transparency, and feedback-driven intelligence.

A Path to Net Zero

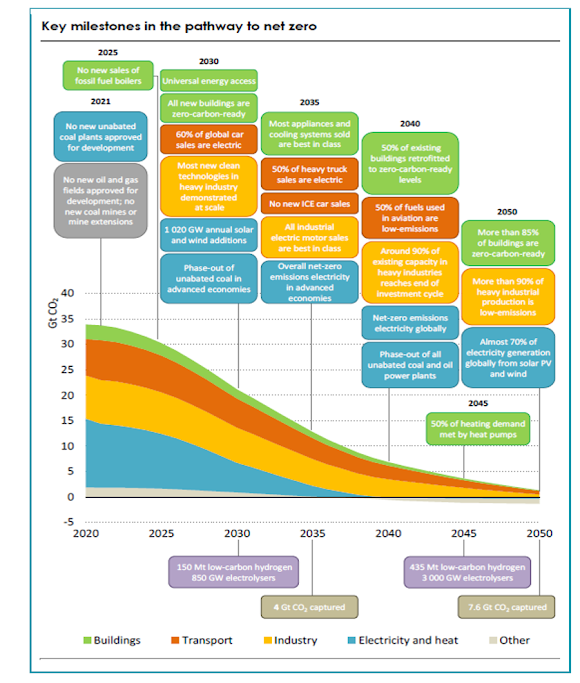

A holistic approach is needed for a scalable path to net zero in addition to key technologies described above.

Source: IEA, Net Zero by 2050 – A Roadmap for the Global Energy Sector Report

All of the above technologies will lead the pathway to a net zero carbon future, slowly and surely the milestones will need to be achieved as humanity takes up the challenge and the opportunity.

Bibliography