A green building is a built structure that has used energy efficient, environmental techniques during its construction and operational phases. The term green building is also used to describe the process of designing, building and operating a built structure or a man-made micro-environment.

Both terms make parts of the broader process of Green Architecture, which is the philosophy rooted in designing a built structure that is responsive to the climate of its site, taking into account climatic considerations in order to provide its occupants a comfortable built environment without stressing natural resources.

What is the need for Green Buildings?

Building operations and construction accounted for about 38% of global emissions, according to UNEP’s 2020 Global Status Report for Building and Construction. Operations of a building accounted for 28% of the global emissions while the allied industries such as cement glass, added another 10%.

UNEP’s report also emphasized on the fact that the sector’s decarbonization progress was slowing down. To achieve the mid-century targets, the emissions should fall by 6% per year till 2030 which seems distant for now.

Overpopulation and unscrupulous urbanization of some regions has placed immense pressure on urban centers leading to a lack of potable water, overcrowding, reduction in forested/landscaped areas, increased pressure on electricity production thereby increasing the prices, overuse of landfills and more.

“According to UNEP, the building sector has the largest potential for significantly reducing GHG emissions compared to other major emitting sectors. The report further says it has the potential to make energy savings of 50% or more in 2050, in support of limiting global temperature rises to 2°C.”

Solutions provided by Green Buildings

Although there are several ways in which the above problems are being addressed, green buildings offer long-term and wide-ranging solutions. These begin from the start of the value chain, from choosing sustainable materials for building to reduce and offset energy requirements of built structures.

Benefits of Green Building

The benefits of green buildings can be grouped within three categories: environmental, economic and social.

One of the most important and direct benefit is that green buildings offer is the climate and the natural environment. According to UNEP, the building sector has the largest potential for significantly reducing GHG emissions compared to other major emitting sectors. The report further says it has the potential to make energy savings of 50% or more in 2050, in support of limiting global temperature rises to 2°C.

According the World Green Building Council, there are several economic benefits to green buildings as well. These include cost savings on utility bills for tenants or households (through energy and water efficiency); lower construction costs and higher property value for building developers; increased occupancy rates or operating costs for building owners; and job creation.

There has been evidence of green buildings having indirect social benefits. Many of these benefits are around the health and wellbeing of people who work in green offices or live in green homes. Better indoor air quality i.e., low concentrations of CO2 and pollutants, and high ventilation rates, can improve performance by 8%. Workers in green, well-ventilated offices also recorded a 101% increase in cognitive scores.

Financing Green Projects

As they say, sustainability comes at a price. Currently the market for green buildings is small. Most projects are institutionalized by government agencies or companies with a high net worth which rely mostly on their built structures for revenue.

For example, ITC Green Centre, Gurugram or Indira Paryavaran Bhawan, New Delhi. With all the long-term benefits of a Green Building there is huge gap in financing the sector. Retail investors, PSBs and even private investors are reluctant to invest in the concept. Their hesitance stems from a variety of factors and causes which have been discussed in the next section.

“A green building project faces barriers attracting private investors due to the long-term payback time, high interest rates, and sometimes very high initial costs. Therefore, to launch green building projects, government support becomes necessary.”

Financial barriers or hindrances in green projects

An extensive empirical study identified 4 key factors that prevent investors from considering financing green building projects. Risk related barriers, capital expenditure, lack of incentives, and initial capital cost are the key obstacles that investors find hinders green building project financing. The findings further revealed significant differences in the views of the professionals regarding the 4 obstacles.

Moreover, Payback time, ROIs and IRRs, are considered to be the 3 biggest downsides in the views of institutional investors. Concretely, investment in a green building project can be returned in about 7-8 years because the benefit of energy saving occurs in the operation stage. This is often accompanied by uncertainties regarding project success, exposing it to greater risks.

A green building project faces barriers attracting private investors due to the long-term payback time, high interest rates, and sometimes very high initial costs. Therefore, to launch green building projects, government support becomes necessary.

Green Buildings as an Investment Opportunity

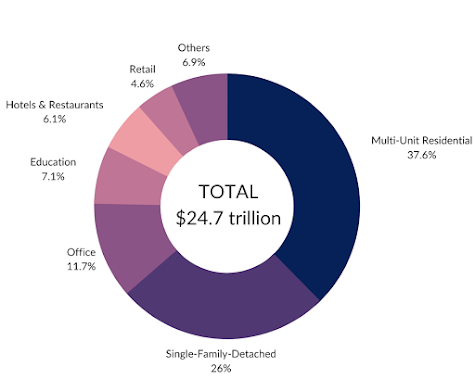

An IFC report showed that the size of investment opportunity in this sectors is $24.7 trillion by the end of 2030 across the emerging market cities, where the population often exceeds 500,000 people. More than 2/3rd of this potential i.e., $17.8 trillion lies in East Asia Pacific and South Asia. Even residential projects present investment opportunities of $15.7 trillion marking more than 60% of the total.

There is strong evidence to show that green buildings and buildings which use renewable energy resources are higher value and lower cost assets.

However, the current investment market for green buildings is just a fraction of the whole investment opportunity. At the time where the emerging markets are struggling with the problem of affordable housing, it has become increasingly difficult to invest in green projects. The figure below shows sector wise investment opportunities.

This clearly shows the huge potential in the green building sector, implying the need for scaling financing for energy efficient buildings explicitly.

Role of different Stakeholders

Investors and Financiers

Key sources of financing for real estate projects include commercial banks.

Construction finance, mortgages, home improvement loans, and green financial products for resource-efficient buildings can significantly accelerate the uptake of green buildings, as can better financial terms such as lower interest rates and longer tenors.

Institutional lenders can be of great help by injecting the much needed liquidity thus enabling the primary lenders to develop new green-financing products.

On the market level, the national and international DFIs help facilitate the entry of new and private investors.

Governments

136 countries in the world have focused on green buildings or ‘building it right’ in their respective NDCs.

Governments can bolster efforts towards green buildings by requiring all the government or public buildings to be made green, thus fueling the investment cycle as well as inspiring the private sector to do the same. This would also help build the technical capacities of architects, engineers and other infrastructure and construction professionals in the green space.

Fiscal incentives like tax breaks, grants, subsidies, loans, and rebates, complemented by non-fiscal incentives such as preferential or expedited permitting, density bonuses and more, along with policy changes would green the building sector.

Regulators

Regulators can mitigate against challenges such as greenwashing, misuse of proceed, and issues the private sector might face in tracking deviations from conventional projects.

A special focus on ESG and climate reporting will help investors as well as the government formulate policies and devise measures.

Disclosures help in maintaining the reliability as well as accountability of the companies deploying green projects thereby increasing the trust of investors.

Private Sector

While some developers and real estate owners have voluntarily adopted green building processes, creating a momentum in scaling their adoption, addressing industry-wide needs with the help of corporates is very important.

Many national and international bodies, certifications and standards are also bringing greater incentives that would help attract private sector.

Bibliography

https://archive.epa.gov/greenbuilding/web/html/about.html

https://www.tandfonline.com/doi/abs/10.1080/15623599.2020.1832182?journalCode=tjcm20