The real estate sector poses a serious threat to maintaining the pre-industrial warming limit of 1.5 degrees Celsius and achieving net-zero emissions in accordance with the Paris Agreement. Currently, 40% of all carbon emissions come from the real estate sector. The percentage can be divided into two categories: embedded carbon emissions from building construction (13%), and operating emissions from daily energy and heating consumption (27%) Given real estate’s carbon footprint, it is a good idea to scale green buildings. Towards this, banks must increase the amount of financial flows (from banking, microcredit, insurance, and investment) from the public, private, and non-profit sectors in order to promote green buildings.

Commercial banks have more than US $110 trillion on their balance sheets and banks serve as a substantial source of mortgage financing, home renovation loans, and development financing for real estate. Despite the lucrative market for banks to invest in financing green projects, many banks in developing nations lack a pipeline of green properties to finance. Banks may promote the use of green building practises to establish this pipeline by offering financial incentives to developers and actively working with them to raise their knowledge and strengthen their expertise in green construction.

Some banks are starting to provide buyers of green homes attractive mortgage conditions in emerging markets, such as reduced down payments, lower interest rates and fees, longer loan tenors and grace periods, or they are starting to approve them for larger loans. For example, the Bank of Bangladesh has mandated that all commercial banks offer a discounted financing rate of 9% for the added cost of green measures implemented in light industry buildings.

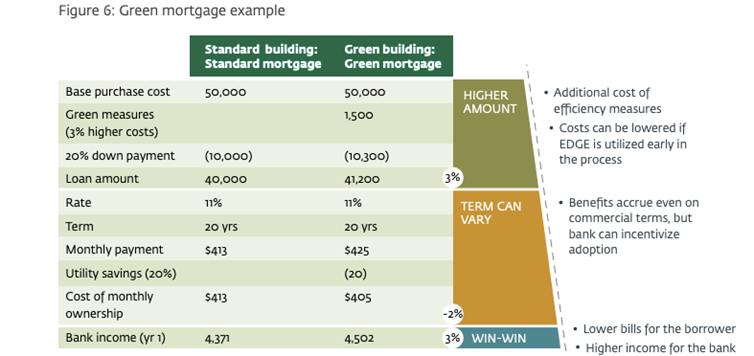

According to the computation in the figure, a lending institution will finance a bigger mortgage to pay for the cost of green improvements, bringing in more revenue for a higher-value and lower-risk asset on its books.

Green property developers have a reduced credit risk profile because green properties sell more quickly and for higher selling premiums. Banks in developing nations can share a portion of their higher income (3 percent in the example above) with developers by offering them a range of financial incentives to encourage green building and expand their pipeline of green properties to finance. Banks gain by owning a portfolio of green assets that are more valuable and less risky. Gaining access to new financial resources like impact funds, green bonds, green credit lines, and green securitizations, which aim to deliver both financial and socially and environmentally good effects, allows bankers and developers to construct a portfolio of green buildings.

Incentivizing behaviour is an effective strategy to draw in more funding and enthusiasm for green real estate financing. As an example, the National Energy Efficiency and Renewable Energy Action initiative launched by the Lebanese government encourages commercial banks to provide low-interest finance to the private sector for initiatives involving renewable energy, energy efficiency, and green building.

Construction financing, mortgages, home repair loans, green financial solutions for resource-efficient structures, as well as enhanced financial terms like lower interest rates and longer tenors, can significantly speed up the adoption of green buildings. Banks can potentially lower their cost of capital by increasing the number of clients they serve and the variety of products they provide, building portfolios with higher value and lower risk, and gaining access to new funding sources through green bonds, green securitizations, and green credit facilities. Institutional investors can increase market liquidity by making investments in green real estate and free up capital for primary lenders to develop fresh green lending solutions.

Bibliography:

https://www.unep.org/news-and-stories/story/why-financial-institutions-are-banking-sustainability

https://www.adb.org/sites/default/files/publication/467886/adbi-wp892.pdf

https://www.iea.org/policies/482-national-energy-efficiency-and-renewable-energy-action-neerea