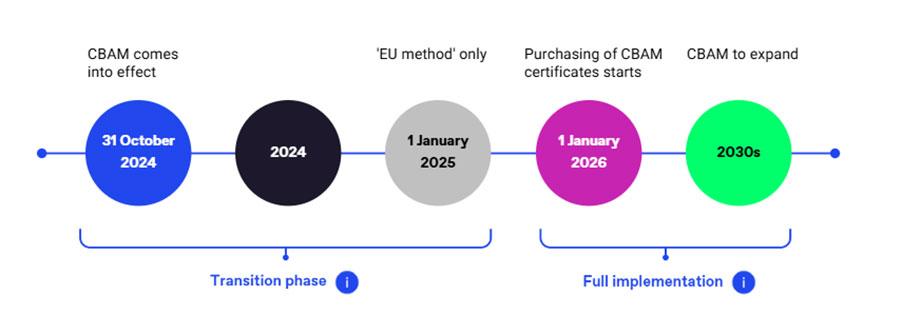

The Carbon Border Adjustment Mechanism (CBAM) is a significant initiative by the European Union (EU) aimed at addressing carbon emissions associated with imported goods. It serves multiple purposes, primarily to ensure that the carbon price for imported products aligns with that of domestic production, thereby preventing “carbon leakage” and promoting cleaner industrial practices globally. The mechanism specifically targets sectors at high risk of carbon leakage, including iron, steel, cement, aluminium, fertilizers, and electricity. Adopted on 17 May 2023, CBAM aims to impose a fair price on carbon emissions embedded in goods imported into the EU, ensuring that these prices reflect the costs borne by EU producers under the EU Emissions Trading System (ETS). The CBAM is designed to be implemented in phases:

Source: Carbon Trust

- Transitional phase (2023-2025): During this period, importers are required to report embedded emissions without financial obligations. Each report must detail the quantities of CBAM goods imported, the associated direct and indirect greenhouse gas emissions, and any applicable carbon price from the country of origin. This phase serves as a pilot to refine methodologies for calculating emissions and prepare stakeholders for full compliance

- Full implementation (2026): Financial obligations will commence, requiring importers to purchase CBAM certificates/authorisation as “authorised declarants,” declare annual quantities of imported CBAM goods along with their embedded emissions and surrender CBAM certificates corresponding to these emissions

How CBAM has fared so far?

- Encouragement of cleaner production:

- Various projects have emerged in response to CBAM’s implementation in the European regions tackling decarbonisation. Such as the LEILAC2 (Low Emissions Intensity Lime and Cement) project in Hannover, Germany

- It aims to capture up to 20% of CO2 emissions from cement production processes. Building on the success of its predecessor, LEILAC1, which captured about 5% of emissions, LEILAC2 is set to run until March 2025 with a total budget of approximately €34.7 million, of which the EU contributes over 46%

- Coordinated by Calix Europe, LEILAC2 involves 15 participants from seven EU member states and two non-EU countries, emphasizing collaboration across borders

- Reports suggest that some non-EU countries are considering implementing their own carbon pricing mechanisms to avoid trade disadvantages. However, for non-EU countries, this means adapting trade policies to align with the carbon pricing mechanisms established by the EU

- Various projects have emerged in response to CBAM’s implementation in the European regions tackling decarbonisation. Such as the LEILAC2 (Low Emissions Intensity Lime and Cement) project in Hannover, Germany

- Reduction in carbon leakage:

- By equalising the carbon costs between domestic and imported goods, the CBAM aims to prevent companies from relocating production to regions with lax climate policies. This has already started levelling the playing field for EU industries

- However, as financial obligations under CBAM have not yet commenced, its direct impact on reducing carbon leakage remains limited so far

- Data collection and reporting:

- The transitional phase has enabled robust data collection on GHG emissions embedded in imports. This data will be critical for enforcing compliance when financial obligations begin in 2026

- Global emission impacts:

- While it is too early for definitive emission reduction metrics, initial analyses suggest that the CBAM encourages cleaner industrial practices globally while supporting the EU’s ambitious climate targets, including a 55% reduction in greenhouse gas emissions by 2030 and achieving climate neutrality by 2050

Challenges ahead

However, the implementation of CBAM faces significant challenges, particularly highlighted during discussions at COP29 in Baku:

- Economic burden on developing nations: Countries such as Brazil, India, and South Africa have raised concerns that the CBAM could serve as a tool for the EU to shield its industries by imposing additional costs on imports from developing nations. The G77 group has warned that this could result in significant trade losses. with African nations potentially facing export reductions of up to 13.9% in aluminium and 8.2% in iron and steel, leading to an estimated 0.5% decline in GDP. Such economic pressures could exacerbate existing vulnerabilities and impede development efforts

- Dependency on global value chains (GVCs): EMDEs are heavily integrated into GVCs, making them susceptible to disruptions caused by geopolitical tensions or shifts in EU policies aimed at achieving strategic autonomy. The EU’s focus on CBAM could inadvertently lead to reduced opportunities for EMDEs in critical sector

- Challenges in transitioning to renewable energy: EMDEs face significant hurdles in transitioning to renewable energy due to infrastructure limitations and the need for stable power supplies. CBAM could adversely affect GDP growth, export revenues, and household consumption in these nations, disproportionately impacting vulnerable groups such as low-skilled workers and women

- Historical inequities in emissions responsibility: Developing nations argue that they should not bear the brunt of climate-related trade restrictions, given that developed countries have historically contributed the majority of global greenhouse gas emissions. Critics emphasise the need for developed nations to provide financial assistance and technology transfer to support decarbonization efforts. However, the EU’s indication that CBAM revenues will not be allocated to assist affected countries has caused dissatisfaction among stakeholders in developing regions

- Infrastructural and technical limitations: Many developing nations lack the necessary infrastructure and technical capacity to comply with CBAM requirements. Inadequate data collection systems hinder accurate measurement of carbon emissions and implementation of required changes. While COP29 discussions proposed a Global Matchmaking Platform (GMP) to coordinate technical and financial support, the lack of detailed plans leaves many nations ill-equipped to meet CBAM standards

- Risk of greenwashing: Critics have highlighted the risk of greenwashing, where companies may make misleading claims about their environmental practices. This undermines consumer trust, complicates regulatory enforcement, and risks increasing costs for consumers without delivering genuine environmental benefits, thereby exacerbating economic inequalities

To maximise its effectiveness and mitigate potential adverse impacts, particularly on developing nations, a multifaceted approach is essential. Following are some solutions suggested that can enhance the implementation of CBAM:

- Technical assistance for developing nations: The EU could provide support to developing countries in implementing their own carbon pricing systems, ensuring they are not disproportionately affected by CBAM. This could include financial aid, technology transfer, and capacity-building initiatives

- Research and development grants: Allocate funds for R&D in sustainable practices within high-emission sectors like steel and cement production. Supporting innovation can lead to breakthroughs that reduce overall emissions and make compliance with CBAM more feasible

- Need for synergistic approach: As the international community grapples with climate change, there is a pressing need to rethink existing institutions or create new frameworks that allow for integrated approaches to climate and trade. This could help mitigate tensions and foster cooperation within the UN Framework Convention on Climate Change (UNFCCC) as it approaches a pivotal year

- Inclusive trade agreements: Engaging EMDEs in trade agreements that not only promote economic ties but also consider their developmental needs can foster a more equitable trading environment

While still in its initial stages, the CBAM has laid a strong foundation for addressing carbon leakage and promoting global decarbonization. However, its success will depend on effective enforcement during its full implementation phase and international cooperation to mitigate trade disputes. Therefore, there is significant need for adopting proactive measures and advocating for fairer policies. If successful, it could serve as a blueprint for other regions aiming to align trade with climate goals.

References

- https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en#guidance

- https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en

- https://climate.ec.europa.eu/eu-action/climate-strategies-targets/2030-climate-targets_en#:~:text=In%202023%2C%20the%20EU%20adopted,climate%2Dneutral%20continent%20by%202050

- https://eur-lex.europa.eu/legal-content/EN/TXT/HTML/?uri=PI_COM:Ares(2023)4079551

- https://www.europarl.europa.eu/RegData/etudes/ATAG/2023/754626/EPRS_ATA(2023)754626_EN.pdf

- https://www.carbontrust.com/en-eu/our-work-and-impact/guides-reports-and-tools/cbam-what-it-means-for-businesses-across-europe

- https://aseanenergy.org/publications/carbon-border-adjustment-mechanism-cbam-implementation-on-reducing-emission-in-the-asean-energy-sector/

- https://www.lse.ac.uk/africa/assets/Documents/AFC-and-LSE-Report-Implications-for-Africa-of-a-CBAM-in-the-EU.pdf