Many things remain unchanged, many commitments remain undelivered, but, extreme climate changes can be prevented. The recently published IPCC report provided a clear picture of the dangerous effects of climate change the world could face if high emissions continue. Alarming statistics are emerging, such as that current CO2 concentration is at its highest rate in 2 million years, sea levels are rising at the fastest rate in the past 3000 years, and arctic sea ice is at its lowest level for 1000 years. These sure did make an impact, however, for thoughts to convert to action may, unfortunately take longer. Earlier, for private investors, it was not all about making a positive impact, but also focus on returns. However, improved studies, historical alpha returns of ESG funds, and returns on green investments now pave the way, encouraging greater focus on impact. The most important emerging perspective for investors is to accelerate private investment to make a positive impact.

There are an increasing number of positive interventions that are looking to address Paris Agreement goals. Rapidly expanding initiatives like increasing renewable energy targets are cropping up around the world. India recently increased its renewable energy target to 450 GW by 2030. Efforts to make a common sustainable/green finance taxonomy are also accelerating, such as the EU and China collaboration in preparing a “Common Ground Taxonomy” to provide a global benchmark for disclosures. Additionally, the increasing commitments by regulators and lawmakers much like the G20 agenda in 2021, contribute significantly in efforts in to tackle climate change.

Below mentioned are three recommendations that could transform the global sustainable finance and ESG space and make great strides towards tackling climate change:

- Mandatory, not voluntary: Standards, benchmarks, and lawmakers like TCFD, SASB and many capital market regulators like SEBI, the SEC, and more, are currently making progress in improving disclosures. Unfortunately, most of them still remain voluntary. Voluntary disclosures do not push the envelope enough to make a change in disclosure practices. Firms continue to operate under the same ‘business-as-usual’ way unless their profits are impacted. Making disclosures mandatory will set the tone for the market and help align businesses with global commitments and goals towards sustainability. This will reflect a substantial change in the short term, bring greater discipline to the market and augment investment decision-making

- Central policy-level changes: Many drastic industry transformations depend on regulatory and policy-level changes, since companies and certain sectors like banking are bound by industry-specific compliance. A policy change would affect an immediate change in action and lead to a shift in the vision and goals of businesses, making them more in line with national or global priorities. For example, US legislation is expected to impose ESG due diligence and disclosures by year-end, amidst demand from investors for transparency around material ESG factors

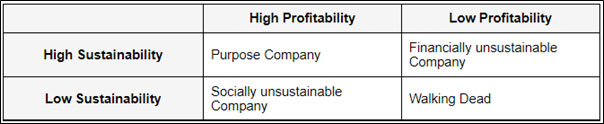

Purpose, not Sustainability targets: Purpose-driven companies last longer than sustainability target-driven companies. Danone is an example of a purpose-driven company – a purpose beyond generating profits. Danone is on a mission to increase shareholder value along with being concise of people and planet’s health. This purpose being at the heart of the company’s long-term vision, helps the management to take a sustainable approach in driving profits. ExxonMobil on the other hand, did have an ambitious sustainability target – reaching net-zero by 2050, however, soon failed to deliver and convince its shareholders. This was due to the fact that no concrete steps were taken post-commitment and the organisation continued to explore more fossil fuel. ExxonMobil failed to strengthen the environmental agenda at the top of the company, eventually failing the purpose to deliver the sustainability target.

Due to the clear purpose by Danone, the company not only can achieve higher profits, but also upheld its sustainability commitments to its people and planet. Often commitments are made, but may fail to deliver. This could be due to overambitious goals or undermining the climate change impact in the coming future. However, if the purpose of the company remains strong, the company sooner or later will deliver the promised targets and align the actions to the final set of goals

- Mainstreaming climate risk management: According to a report by the Shakti Foundation, “mainstreaming” implies a shift from financing climate activities in incremental ways, to making climate change, both in terms of opportunities and risk as a core consideration and “lens” through which institutions deploy capital. The World Bank propagates that mainstreaming climate change considerations throughout financial institution’s operations, and in their investing and lending activities, will enable financial institutions to deliver better, more sustainable, short-term, and long-term development and financial returns.

The catastrophic effects of climate change are already visible, with extreme weather around the world damaging property, disrupting economic activity, and harming human life. Mitigating climate change and reducing greenhouse gas emissions are major global challenges. This requires “mainstreaming of the climate risks” in every financial decision that is to be made.

The above 4 key recommendations could bring an immediate 360-degree change in the ways we look at sustainability targets and bring more trust in the process to achieve the goals according to the Paris Agreement.

Bibliography

https://www.lexology.com/library/detail.aspx?g=c3e9ba9e-beb6-42d9-b7eb-359e2917898b

https://www.ipcc.ch/report/sixth-assessment-report-working-group-i/

https://www.senecaesg.com/blog/green-taxonomies-china-eu-and-common-ground-taxonomy/

https://www.dw.com/en/g20-summit-world-leaders-agree-on-climate-deal/a-49408651

https://www.clientearth.org/the-greenwashing-files/exxonmobil/