WHO WE ARE

WHO WE ARE

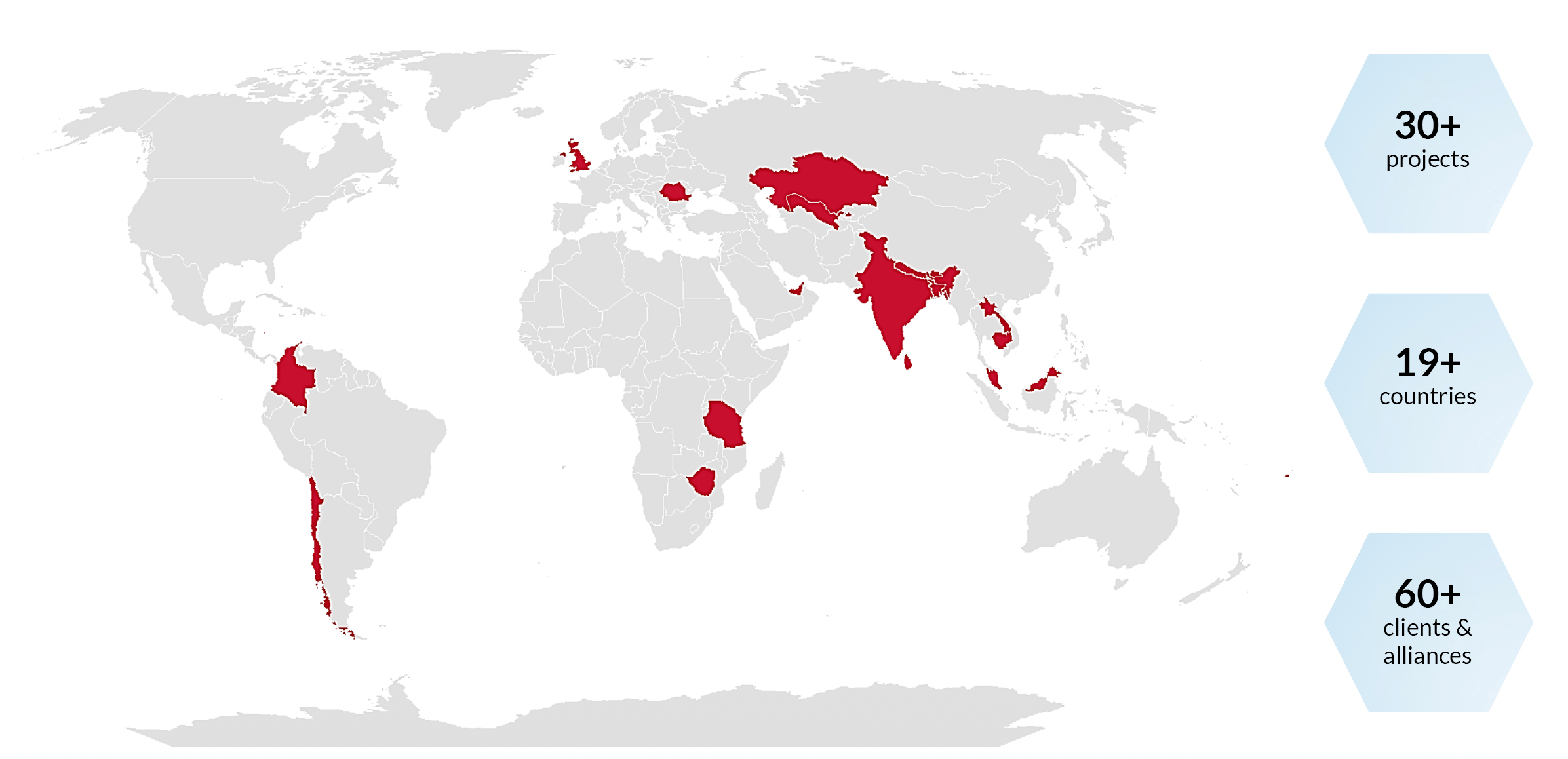

auctusESG works with some of the largest and most prominent global financial institutions, national and subnational governments, policymakers and financial market regulators, and international finance and development finance institutions, including various UN agencies.

PURPOSE

OUR VISION

OUR MISSION

SERVICES

KEY STAKEHOLDERS

THEMES

Adaptation &

mitigation

Climate

transition

Climate risk

management

NAMITA VIKAS

Founder & Managing Director

JASRAJ SINGH VIRDI

Co-Founder & CEO

FOUNDING TEAM

NAMITA VIKAS

Founder & Managing Director

JASRAJ SINGH VIRDI

Co-Founder & CEO

Meet our Team

ADVISORY BOARD

Advisor to International Finance Corporation (IFC), Institute of International Finance (IIF) & Mastercard & Former Global Chief Investment Officer, IFC

Arun Kumar Sharma is the President of Grovepike Associates. A global leader in structured finance, Mr Sharma has pioneered securitisation and related structured products across a range of markets. He is widely regarded as one of the pioneers of blended finance and climate finance.

Mr Sharma serves as a senior adviser to a number of global corporations and international agencies, including Mastercard, AXA Insurance, and the International Finance Corporation (IFC/World Bank). He is also a board member of the Grass Roots Trading Network for Women, an Indian non-profit organisation that connects women micro-entrepreneurs to markets on fair and equitable terms. His advisory work focuses on sustainable finance strategies supporting renewable energy, clean transportation, and green housing — including the use of blended finance solutions to advance a variety of climate-friendly projects.

Prior to his current role, Mr Sharma was Chief Investment Officer at the IFC, where he led numerous climate finance projects and initiatives aimed at supporting renewable energy, energy efficiency, cleaner production, and small-scale off-grid solar systems. These initiatives had a direct impact on reducing global greenhouse gas emissions and promoting a more climate-resilient model of economic development.

As part of this work, Mr Sharma established India’s first private sector green bank — Tata Cleantech Capital — in a joint venture with the Tata Group, to finance a broad spectrum of climate-aligned businesses. He structured the IFC’s first Green Bond investment transaction in emerging markets, negotiated and closed the first credit line for rooftop solar installations from the Green Climate Fund for Tata Cleantech Capital, and initiated India’s first programme to convert diesel pumps to solar-powered alternatives for micro-enterprise salt producer.

Founder, the Impact Commons, Former Assistant Secretary-General and Deputy Executive Director at UN Women. Former IFC

Ms. Bhatia is the founder of Impact Commons, a strategic advisory, advocacy, convening, and capacity-building organisation. Until April 2023, she served as Assistant Secretary-General of the United Nations and Deputy Executive Director of UN Women — the flagship entity within the UN system dedicated to advancing gender equality and the empowerment of women globally.

In that role, she led external stakeholder engagement with both public and private sector partners, alongside responsibilities for fundraising, communications, strategic planning, finance, and human resources. She also spearheaded the development of new strategic alliances with international financial institutions, impact investors, corporates, and other key stakeholders.

Ms Bhatia currently serves on the board of BancoSol, a leading bank in Latin America; the advisory board of Fasanara Capital, a major UK asset manager; and the United Nations Sanitation and Hygiene Fund. She is also a visiting fellow at King’s College London.

Prior to her tenure at UN Women, Ms Bhatia had a distinguished career spanning over 30 years at the World Bank Group, where she held various leadership and management positions across the International Finance Corporation (IFC), the World Bank, and the Multilateral Investment Guarantee Agency (MIGA).

Ms. Bhatia is globally recognised as a thought leader on gender equality and the empowerment of women. A compelling and persuasive communicator, she advocates effectively to shape public policy agendas. Her work has been featured in numerous international publications and media platforms, including CNN, BBC, France 24, Deutsche Welle, Jeune Afrique, Digital Future Society, Channel News Asia, Vogue, Qazaq TV, and The Telegraph.

Member of Advisory Boards of HSBC Real Economy Green Investment Opportunity, OECD Centre for Green Finance and Investment & Former Climate & Environmental Finance Head, European Investment Bank

Christopher Knowles is an independent adviser specialising in the financing of different types of

sustainable assets. He has been engaged in the finance of infrastructure, climate and environmental

assets for over 40 years, much of this time with the European Investment Bank. As EIB’s Head of

Infrastructure Funds and Climate Finance he oversaw the EIB’s volume of climate financing grow tenfold

to $20bn p.aand led the creation of a $3bn portfolio of investment in 60 equity, debt and blended fund

vehicles, the majority dedicated to environment and climate assets.

Many of these supported SME vehicles, sometimes following highly innovative models. He has a broad,

practical knowledge of the sustainable finance agenda, and is acknowledged internationally as a thought

leader on climate finance. He has worked at all levels of the public and private financial worlds,

throughout the EU and in many emerging markets. Currently he serves as NED on a number of investment

funds, advises various policy advocacy and research entities, and works with startup fund management

teams, all in the sustainable space.He has a BA Econ. and an MSc in Management Science from the

University of Durham.

Research Professor & Director, Public Policy School, University of Maryland, USA

Dr Irving Mintzer is a Professor at the School of Public Policy, University of Maryland (USA), and Director of the Initiative on Closing the Investment Gap in Sustainable Infrastructure. He is an internationally recognised expert on energy technologies and has been involved in international negotiations on energy, global climate change, and stratospheric ozone depletion for over 30 years. His research focuses on the implications of public and private investment for climate change, as well as the impacts of climate change on human societies and natural ecosystems.

Dr Mintzer has provided extensive consultancy services to multinational corporations and multilateral financial institutions, including Royal Dutch Shell, Tokyo Electric Power, CEMEX, Swiss Re, UNEP, UNDP, UNFCCC, the World Bank, and the Global Environment Facility. He also served for two years as Senior Adviser to the Assistant Secretary for Policy and International Affairs at the US Department of Energy, where he focused on critical materials and strategic resource issues.

From 2009 to 2014, Dr Mintzer was Senior Adviser to Potomac Asset Management Company and served as Managing Director and Chief Strategist for the Potomac Energy Fund. He holds an MBA in Applied Economics and a PhD in Energy and Resources from the University of California, Berkeley.

Founder, Finance in Motion

Elvira Lefting is a founder of Finance in Motion, one of the world’s leading impact investing asset managers, with US$4 billion in assets under management across climate, social, and nature-focused strategies in over 40 lower- and middle-income countries. A pioneer in blended finance, Finance in Motion has an extensive track record of catalysing private investment through risk-enhancing instruments supported by public and philanthropic partners.

Elvira’s expertise in public–private partnership models and blended finance has been instrumental in the creation of large-scale impact investment funds focused on decarbonisation, sustainable land use, and conservation. She has dedicated her career exclusively to development finance and capacity building, working to enable a green and equitable transformation of the financial and corporate sectors, and to develop an investable asset class that is attractive to private investors.

Elvira has spent decades working in and with emerging markets across both the public and private sectors, with a focus on project bankability and the ability of financial systems and investors to support such investments. Since its founding over 15 years ago, she has led the growth and global expansion of Finance in Motion’s investment operations. She holds an M.A. in Slavic Studies from Heidelberg University.

Senior Director for Finance and the Private Sector at the World Resources Institute

Nick joined the Grantham Research Institute in February 2018 as Professor in Practice for Sustainable Finance, where he leads the sustainable finance research theme. His work focuses on mobilising finance for climate action in ways that support a just transition, advancing the role of central banks and regulators in sustainable development, and exploring how the financial system can enable the restoration of nature.

Nick served as Executive Director of the Institute’s Just Transition Finance Lab from 2024 to 2025 and currently serves as its Chair.

He is the author of The Road to Net Zero Finance for the UK’s Climate Change Committee, and a co-founder of the Financing the Just Transition Alliance. He also serves as a Commissioner on Scotland’s Just Transition Commission.

Nick leads the finance platform for the Place-based Climate Action Network and is co-chair of the International Network for Sustainable Finance Policy Insights, Research and Exchange (INSPIRE).

Former MD & CEO, Deutsche Bank AG

Ravneet is one of India’s most senior bankers, with over three and a half decades of experience in the industry, the majority of which was spent at Deutsche Bank across corporate banking, corporate finance, global markets, and country management. He served as CEO of Deutsche Bank India from 2012 to 2019 and was a member of the bank’s Asia Pacific Executive Committee during that period. He was also an elected member of the Management Committee of the Indian Banks’ Association (IBA), the apex body for banking in India, for several years.

In 2019, Ravneet was appointed Managing Director and Chief Executive Officer of Yes Bank, a position he held for one year.

He currently serves on the Board of Directors of Trent Ltd, the listed retail arm of the Tata Group. He is also a member of the Advisory Board of auctusESG, and the National Sports Committee of the Confederation of Indian Industry (CII). From 2015 to 2022, he was a member of the Advisory Board of the IPL franchise Rajasthan Royals.

Founder & CEO, Climate Bond Initiative

Sean Kidney is Chief Executive Officer of the Climate Bonds Initiative, an international NGO working to mobilise global capital for climate action. He oversees green bond development programmes across six continents, with an estimated US$3 trillion now outstanding. His work includes market definition—such as taxonomies, data provision to green bond indices and investors, and green bond certification—as well as support for public institutions.

Sean serves on numerous high-level advisory bodies, including the EU Platform on Sustainable Finance, the Sustainable Finance Advisory Panel of the Monetary Authority of Singapore, and sovereign green bond advisory committees in France and the United Kingdom. He is also a member of the Finance Industry Advisory Board of the International Energy Agency, the Finance Advisory Committee of the Food and Agriculture Organization (FAO), and Japan’s GX Accelerator Advisory Committee.